Sustainability

- In order for UBOT to implement corporate social responsibility so as to drive economic, environmental, and social progress and thus achieve the goal of sustainable development, UBOT has gradually implemented the 17 goals in response to the United Nations Sustainable Development Goals (SDGs) with a view to bolstering our contribution to the national economy, improving the quality of life of employees, community and society, as well as facilitating sustainable development-oriented competitive advantage while conforming to international development trends. When pursuing sustainable operation and profit, UBOT not only attaches great importance to stakeholders’ rights and interests, but also places great emphasis on environmental, social and corporate governance factors, and includes them in our management approaches and operating activities while establishing a sustainable development philosophy in which our goals and vision are rooted in economic development, social justice, and environmental protection.

- In an effort to promote corporate social responsibility and sustainable development, the Board of Directors passed a resolution to establish the Regulations Governing the Establishment of Corporate Social Responsibility Committee in 2015, and then set up the Union Bank of Taiwan Corporate Social Responsibility Committee (CSR Committee). In line with international development trends while realizing the goal of sustainable development, the Board of Directors approved amendments to the Sustainable Development Committee Charter in 2022, where the Corporate Social Responsibility Committee was renamed “Sustainable Development Committee” (also known as ESG Committee) to serve as the supreme sustainable development decision-making center within the company, while the Union Bank of Taiwan Sustainable Development Best Practice Principles were formulated to manage the risks and impacts caused by UBOT to the economy, the environment, and society.

- The ESG Committee is tasked with overseeing UBOT’s sustainable development policy, management approach, and specific promotion programs.

- The ESG Committee has a number of subordinated teams in a number of areas, including Corporate Governance, Customer Care, Employee Care, Environmental Sustainability, Social Welfare, and Sustainable Finance where these teams are responsible for drafting schemes for UBOT’s sustainable development execution plan or matters instructed by the ESG Committee, and then submit them to the ESG Committee for review or for future reference.

Structure of the Sustainable Development Committee

Stakeholder Identification

UBOT’s stakeholders primarily consist of shareholders/investors, customers, employees, partners/suppliers, community/general public, government/competent authorities, and media.

UBOT’s stakeholders primarily consist of shareholders/investors, customers, employees, partners/suppliers, community/general public, government/competent authorities, and media.

- Regarding the above stakeholders, members of the various functional groups under ESG Committee were responsible for making interaction, collecting opinions and making communication with the social public and stakeholders via various channels and platforms, including a dedicated section on UBOT's corporate website in both Chinese and English, visitor message, annual report, shareholders’ meetings, 24-hour customer service hotline and service mailbox, text customer service app, customer suggestion box, community seminars, and various social welfare activities, etc. In addition, UBOT reports the status of communication with stakeholders to the Board of Directors on a regular basis each year. The identification of stakeholders, as well as method and channels of communication with stakeholders are detailed in the following table.

- For information on Communication with stakeholders in 2024, please refer to stakeholder discussion section of the sustainability report

An identification of material topics is conducted annually according to GRI 3: Material Topics. For material topics with higher impact levels, corresponding ESG strategies and management objectives were formulated in response to stakeholders' expectations.

Confirmation of Material Topics

Confirmation of Material Topics

Confirmation of Material Topics

Confirmation of Material Topics

-

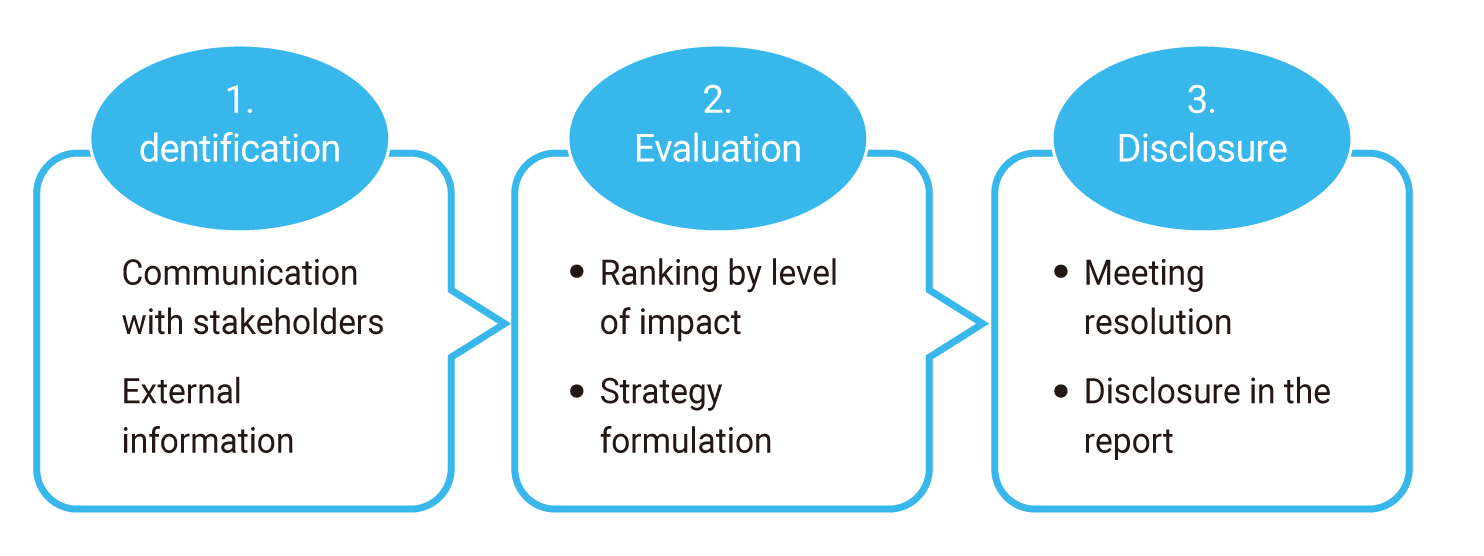

Analysis of Impact Materiality

Distribute external questionnaires to survey stakeholders' level of concern regarding sustainability issues. After defining the key issues, senior executives of the Bank were invited to assess the positive and negative impacts of 21 sustainability issues on the economy, environment, and people (human rights). The evaluation results were ranked as shown in the following chart, with the impact levels arranged from highest to lowest.

-

Double Materiality Analysis

Through the Assessment of Financial Materiality Questionnaire, senior executives of the Bank were asked to assist in evaluating the financial materiality of sustainability issues (i.e., the impact on the company's operations and degree of financial impact). By integrating the "Sustainability Impact Level" and the "Operational and Financial Impact Level," a dual materiality matrix was produced to identify topics with dual materiality that have significant impacts on both the company's financial operations and external influences. According to the analysis results, there are a total of 11 topics with dual materiality.

Board Diversity Policy

The Bank adopted the "Corporate Governance Code of Practice" at the 18th meeting of the 8th Board of Directors on March 18, 2015, and set out a diversity policy in Chapter 4 "Strengthening the Functions of the Board of Directors". The nomination and selection of the Bank's Board of Directors is conducted in accordance with the provisions of the Company's Articles of Association and adopts a "candidate nomination system". In addition to evaluating the academic qualifications of each candidate, the Bank also consults with stakeholders and follows the "Procedures for Election of Directors" and " Corporate Governance Best Practice Principles " to ensure the diversity and independence of board members. Pursuant to Article 29, Paragraph 1 of the Bank's "Corporate Governance Code of Practice", members of the Board of Directors should generally possess the knowledge, skills and qualities necessary to perform their duties. In order to achieve the ideal goal of corporate governance of the Bank, the Board of Directors as a whole should possess the following capabilities:

Board of Directors Register of Directors

The Bank adopted the "Corporate Governance Code of Practice" at the 18th meeting of the 8th Board of Directors on March 18, 2015, and set out a diversity policy in Chapter 4 "Strengthening the Functions of the Board of Directors". The nomination and selection of the Bank's Board of Directors is conducted in accordance with the provisions of the Company's Articles of Association and adopts a "candidate nomination system". In addition to evaluating the academic qualifications of each candidate, the Bank also consults with stakeholders and follows the "Procedures for Election of Directors" and " Corporate Governance Best Practice Principles " to ensure the diversity and independence of board members. Pursuant to Article 29, Paragraph 1 of the Bank's "Corporate Governance Code of Practice", members of the Board of Directors should generally possess the knowledge, skills and qualities necessary to perform their duties. In order to achieve the ideal goal of corporate governance of the Bank, the Board of Directors as a whole should possess the following capabilities:

- Operational judgment ability

- Accounting and financial analysis skills

- Business management capabilities

- Risk management capabilities

- Crisis management capabilities

- Industry knowledge

- International market perspective

- Leadership

- Decision-making ability

Board of Directors Register of Directors

-

Diversity and Independence of the directors and supervisors

Name Nationality Gender Professional designation and experience Diversified core program Operation judgement Corporate management Finance and accounting Industry and academic knowledge International view of market Leadership and decision-making Risk management Jeff Lin Republic of China Male V V V V V V V Zhen-Xong Jiang Republic of China Male V V V V V Yao-Hsien Li Republic of China Male V V V V V V V Tzung-Hang Lee Republic of China Male V V V V Lin-Yu Fan Republic of China Female V V V V V V Han-Ming Hsieh Republic of China Male V V V V V V Si-Yong Lin Republic of China Male V V V V V V Wen-Ming Li Republic of China Male V V V V V Herman Tu Republic of China Male V V V V V V V -

Diversity in the Board of Directors

- The Bank's policy on diversity is based on the following specific objectives and circumstances: Board members should have different professional knowledge and skills, gender and age. In order to achieve the ideal goal of corporate governance, the Board of Directors as a whole should possess the following competencies: operational judgment, business management, accounting and finance, industry knowledge, international market view, leadership decision-making, and risk management, etc. It is expected that at least three out of the total number of Board members should possess any of these competencies, and that at least four out of the seven competencies mentioned above should be possessed by individual Board members. Currently, members of the Board of Directors possess the professional qualifications listed in the table above, and have achieved the goal of diversifying their professional knowledge.

- In addition, the Bank also attaches great importance to gender equality in the composition of the Board of Directors, and has at least one or more female directors since the establishment of the Board. At present, there is one female director on the Board of Directors, accounting for 11.11%, which is in line with the Bank's plan, but in order to strengthen the diversity of directors, the proportion will be gradually increased in the future, and it is expected to achieve the ideal goal of more than one-third.

- The current age range of board members is: one (11.1%) is between 50 and 59 years old, three (33.3%) are between 60 and 69 years old, four (44.5%) are between 70 and 79 years old, and one (11.1%) is between 80 and 89 years old, thus achieving the goal of age diversity.

- Currently, three board members have served for more than 20 years (33.3%), and six have served for less than 5 years (66.7%), with an average term of 12.93 years.

-

Board Independence

The Bank has three independent directors (33.3%), two independent directors were reappointed for a second term, and one independent director assumed office in June 113th.

In order to strengthen the independence of the Board of Directors, starting from the 11th Board of Directors, the term of office of independent directors will not exceed three consecutive terms.

None of the independent directors of the Bank is also an independent director of another public company. - Diversity of directors is oriented, complementary, and implemented. In the future, the Bank will continue to update its diversity policy in a timely manner depending on the operation, business model, and development needs of the Board of Directors, including, but not limited to, the criteria for the two major aspects of basic qualifications and values, and professional knowledge and skills, so as to ensure that the Board members generally possess the knowledge, skills, and qualities necessary for the performance of their duties.

- Board related information

-

Audit Committee

Register of Independent DirectorsTitle Name of Director Experience & Qualification Independent Managing Director Yao-Hsien Li Manager of Federal Bills Finance Co. ;

Manager of UBOT Bills Finance DepartmentIndependent Director Tzung-Hang Lee the Board of Examiner ;

Visiting Scholar of University of Manchester;

Professor of Tamkang UniversityIndependent Director Lin-Yu Fan VP of , Fuh Hwa Securities Investment Trust Co., Ltd;

Jian Fuh Hwa Securities Investment Trust Co., Ltd;

Director of Union Insurance Co., Ltd. -

Information about the Audit Committee

The Audit Committee is a functional committee established under the Board of Directors. The Board of Directors, in order to improve its supervisory function and to strengthen the management function, appoints independent persons with professional backgrounds as members of the Audit Committee to assist the Board of Directors in making decisions by dividing the work into specialized roles and by taking an independent stance, so that the management's operating activities can be more effectively supervised.

In accordance with Article 14-4 of the Securities and Exchange Act, the Company established an Audit Committee on 8 June, 2016, which consists of all independent directors and has three members.

UBOT Organizational procedures of the audit committee -

Remuneration Committee

Remuneration Committee Members

Committee member Lin-Yu Fan possesses industry-academia knowledge and expertise in operational judgment, while Tzung-Hang Lee has professional expertise in information technology, e-commerce, digital economy and other fields and extensive work experience, which meet the professional capabilities required by the committee.Title Name of Director Experience & Qualification Member Lin-Yu Fan VP of , Fuh Hwa Securities Investment Trust Co., Ltd.

Jian Fuh Hwa Securities Investment Trust Co., Ltd.

Director of Union Insurance Co., Ltd.Member Tzung-Hang Lee The Board of Examiner.

Visiting Scholar of University of Manchester.

Professor of Tamkang University.Member Wen-Ming Li Taiwan Chemical Fiber Corporation Specialist.

Senior Specialist of Federal Construction Enterprise Co., Ltd.

Managing Director of E Ink Forex Brokerage Co., Ltd. -

Information about the Remuneration Committee

The purpose of the Remuneration Committee is to establish and review the policies, systems, standards and structures for the performance evaluation and remuneration of the Company's directors and managers, and to submit its recommendations to the Board of Directors for discussion.

Remuneration Committee Organizational Procedures -

Scope of Responsibilities:

To faithfully perform the following duties with the care of a good steward and to be accountable to the Board of Directors, and to submit proposals for discussion by the Board of Directors.

To establish and periodically review the policies, systems, standards and structures for performance evaluation and compensation of directors and managers.

Evaluate and set the compensation of directors and managers on a regular basis. -

Nomination Committee

Nomination Committee Members

Committee member Lin-Yu Fan possesses industry-academia knowledge and expertise in operational judgment, while Tzung-Hang Lee has professional expertise in information technology, e-commerce, digital economy and other fields and extensive work experience, which meet the professional capabilities required by the committee.Title Name of Director Experience & Qualification Member Lin-Yu Fan VP of , Fuh Hwa Securities Investment Trust Co., Ltd.

Jian Fuh Hwa Securities Investment Trust Co., Ltd.

Director of Union Insurance Co., Ltd.Member Tzung-Hang Lee The Board of Examiner.

Visiting Scholar of University of Manchester.

Professor of Tamkang University.Member Jeff Lin Director of UBOT.

Vice President of UBOT.

President of UBOT. -

Information about the Nomination Committee

Nomination Committee Organizational procedures -

Communication policy between independent directors and auditors

Communication between independent internal directors and auditors

The Chief Auditor is involved in all Board of Directors meetings and Audit Committee meetings, and reports regularly to the Audit Committee on the progress of ongoing audits. Before the end of the financial year, the internal audit department would submit in writing the next year’s audit plan for review by the Audit Committee. Furthermore, internal auditors engage independent directors in half-yearly meetings to present internal audit reports and to discuss any weaknesses found in the internal control system.

Communication between independent directors and accountants

The CPA hold regular meetings with the independent directors on a semi-annual basis on the audit method of financial reports and major audit adjustments

-

Articles of Association and Regulations

UBOT Articles of Association

UBOT Corporate Governance Best Practice Principles

UBOT Sustainable Development Best Practice Principles

-

Tax Governance Policy

UBOT Tax Governance Policy

-

Procedure Governing the Acquisition and Disposal of Assets

UBOT Procedure Governing the Acquisition and Disposal of Assets -

External auditors’ independence

The Bank's Audit Committee evaluates the independence and suitability of its assigned CPAs annually. In addition to requiring CPAs to provide the "Declaration of Independence" and "Audit Quality Indicators (AQIs)," the audit committee shall also evaluate the independence and suitability of the assigned CPAs in accordance with CPAs Independence Assessment Standards(Note 1) and the 13 items of AQI indicator for evaluation. It was confirmed that the CPAs have no other financial interests or business relationship with the Bank, except for the expenses of audit and taxation matters, and that the CPAs’family members do not violate the independence requirements. AQI information is used as reference to confirm that the CPAs and the firm have the training hours that are comparable to the industry average, and the Company will continue to introduce digital audit tools in the next 3 years to improve audit quality. The evaluation results of the most recent year were discussed and approved by the Audit Committee on March 10, 2025, and were submitted to the Board of Directors' resolution on March 10, 2025 to evaluate the independence and suitability of the CPAs.

Note 1: CPAs Independence Assessment StandardsEvaluation Items Evaluation Result Independence I. To maintain the independence of the CPAs engaged in audit and certification, the following principles shall be observed: (I) Whether there is any significant financial interest relationship with the Bank. None Yes (II) Whether there is any improper relationship with the Bank. None Yes (III) Whether the CPAs make the members of the audit service team honest, fair, objective and independent. Yes Yes II. Does the CPAs avoid the following situations that affect their independence: (I) Whether the Bank obtains financial interests through the Bank, or whether there is a conflict of interest with the Bank due to other matters of interest. None Yes (II) Is there any joint investment or profit sharing with the Bank. None Yes (III) Whether the company uses the name of its certified public accountant for others? None Yes (IV) Having any money lending or lending relationship with the Bank, except for normal dealings with financial institutions? None Yes (V) Are there any management functions that are involved in the decision-making of the Bank? None Yes (VI) Concurrently engaged in any other business that may lose its independence? None Yes (VII) Any director/supervisor serving in the Bank, or any position that has a direct and significant impact on the audit case. None Yes (VIII) Are there any defenders of the Bank's positions or opinions that causes doubts about the objectivity of such opinions? None Yes (IX) Are there any relatives of the directors, supervisors, managers, or personnel who have a significant impact on the audit of the Bank? None Yes (X) Are there any business-related commissions received? None Yes -

Operating procedure for internal important information

In order to establish the Bank’s fair important internal information processing and disclosure mechanism to prevent information from being disclosed inadequately and to ensure the accuracy and consistency of the information released by the Bank to the public and enhance the control over prevention of insider trading, the Bank defined the “Operating Procedure for Processing of Important Internal Information”.

Including (but not limited to) directors are not allowed to trade their stocks during the closed period of 30 days before the announcement of annual financial reports and 15 days before the announcement of quarterly financial reports , and relevant contents are placed in the Company's internal system. -

Specific implementation status of ban on insider trading

Before the annual or quarterly closed period when stocks are prohibited from trading, the Company will issue a letter reminding directors, managers and insiders of the prohibition on stock trading. -

Appointment, promotion, appraisal, salary and compensation procedures for internal auditors

The Company has an Internal Audit System, which is published in the internal system, and stipulates that the appointment, removal, promotion, rewards and punishment, rotation, and evaluation of internal auditors shall be signed by the Chief Auditor and reported to the Chairman of the Board of Directors for his/her approval. However, personnel involved in other management and business units should be approved by the President after consulting with the personnel unit in advance before signing and submitting to the Chairman for approval. Salary and compensation are handled in accordance with the “Key Points for Salary Operations” approved by the Board of Directors. -

Human Rights Due Diligence Process

The Bank has established a human rights due diligence process and has taken appropriate measures to improve the human rights impact of its business activities in order to achieve the goal of “Talent Stainability”.

-

Union Bank Of Taiwan Preventive Program against Unlawful Acts of Violence in the Performance of Duty

The Bank has established the “Preventive Program against Unlawful Acts of Violence in the Performance of Duty” to provide employees with the opportunity to file complaints about workplace violence, workplace bullying, sexual harassment, or employment discrimination in order to maintain a safe workplace environment. A written statement on the prevention of workplace violence is publicly announced and posted in each workplace, and unit supervisors are required to fill out a form to confirm the status of potentially unlawful workplace behaviors. The supervisors are required to check and identify whether or not the behavior constitutes workplace harassment, and they are also required to perform supervisory functions to prohibit potential workplace harassment among their colleagues.

The Bank encourages employees to report all incidents of aggression or intimidation and assists in tracking them down. The rights and privacy of the victims of complaints or notifications are kept completely confidential. Upon receipt of a complaint, the department shall, depending on the type and seriousness of the case, assign appropriate personnel to set up an investigation team within three days to conduct mediation or investigation (if the complainant and the complainee agree to the mediation, they may not enter into the investigation process) and respond to the incident. If the investigation process is initiated, the investigation team should consist of at least three members, including at least two external professionals. When the investigation team meets, at least one-half of all members should attend the meeting, and at least one-half of the external professionals should attend the meeting. The investigation period should be completed within two months; if necessary, it may be extended by one month to avoid any disadvantage to the complainant or relevant personnel.At the same time, the victim is provided with job adjustment, psychological counseling, and medical and legal assistance. Upon completion of the investigation, the case is submitted to the Personnel Review Committee/Sexual Harassment Review Committee for consideration and punishment. Review the environment and job redesign after the incident. If the preventive or control measures are found to be insufficient, the implementation method or priority should be adjusted in a timely manner to identify room for improvement. -

Remuneration Policy for President and Senior Executive Vice President

The Bank's President and Senior Executive Vice President receive fixed salaries based on the Manager's Compensation Gap Table, and the Bank's President and Senior Executive Vice President receive variable salaries that are closely related to various indicators of the Bank's business performance in order to ensure the Bank's sustainable operation and development. The variable compensation is divided into short-term and long-term incentives, with short-term incentives paid in cash and long-term incentives paid in the form of 100% linked stock.-

Short-term incentive pay

* Calculated and adjusted according to individual performanceItem Calculation Indicators Weight Annual Performance Bonus Financial Indicators (Net Income After Tax, Earnings Per Share After Tax, Return on Assets) 40% Compliance and Internal Control Indicators 25% Significant Issues Indicator (top three significant issues of the year, if duplicated with other indicators, then deferred downward) 15% Risk management indicators (credit risk, market risk, climate change and environmental sustainability risk) 10% Financial Sustainability Performance Indicators 10% -

Long-term incentive pay

Item Calculation Indicators Employee remuneration allotment Earnings before taxes Performance grade

-

Short-term incentive pay

However, the first application shall be within five years after the announcement.

-

Risk Management Policy, Procedures, Scope, Organizational Structure, and Key Operations

Risk Management Policy, Procedures, Scope, Organizational Structure, and Key Operations

UBOT Risk Management Policy

Implement Financial Cyber Security Action Plan and measures to continuously enhance cybersecurity protection, creating a secure financial service development environment. This serves as the foundation for financial technology innovation, providing consumers with secure, convenient, and diverse financial services.

System and Structure of Legal Compliance

The Bank has established a legal compliance system to form three defense lines together with self-audit, risk management and internal audit, and maintained effective and proper operation of the internal control system via pre-event planning, in-process monitoring and post-event verification.

The Bank's Legal Affair & Compliance Department, which reports directly to the General Manager, serves as the Head Office's legal compliance unit. It is subdivided into the Legal Affairs Division, Legal Compliance Division, Money Laundering Planning and Management Division, Money Laundering Transaction Monitoring Division, Fraud Prevention Division, and Legal Affairs Division. The Legal Affairs Division also has several legal centers and small claims legal centers. The Head Office assigned one senior supervisor to act as the Head Office’s Legal Compliance Supervisor to be responsible for legal compliance affairs of the whole bank, and for issuing opinions conforming to laws and internal regulations. This supervisor leads the personnel of the Legal Compliance Division in jointly managing, planning, and executing the Bank's compliance system. This supervisor also concurrently holds the positions of Chief Legal Officer, Anti-Money Laundering and Counter-Terrorism Financing Officer, and Fraud Prevention Officer. Prior to the Bank launching various new goods, services and applying to the competent authority for handling new businesses, this officer affixes their signature as the responsible person.

The Head Office’s legal compliance units and each domestic unit assigned personnel conforming to legal qualifications to act as their legal compliance supervisor and to be responsible for executing legal compliance matters. They also set assistant legal compliance supervisors in various units (including the Head Office’s branches and various business centers stationed in the branches) to assist the legal compliance supervisors in handing legal compliance matters so as to convey and advocate laws effectively.

Overview and Operation Condition of Legal Compliance

The Bank has established a legal compliance system to form three defense lines together with self-audit, risk management and internal audit, and maintained effective and proper operation of the internal control system via pre-event planning, in-process monitoring and post-event verification.

The Bank's Legal Affair & Compliance Department, which reports directly to the General Manager, serves as the Head Office's legal compliance unit. It is subdivided into the Legal Affairs Division, Legal Compliance Division, Money Laundering Planning and Management Division, Money Laundering Transaction Monitoring Division, Fraud Prevention Division, and Legal Affairs Division. The Legal Affairs Division also has several legal centers and small claims legal centers. The Head Office assigned one senior supervisor to act as the Head Office’s Legal Compliance Supervisor to be responsible for legal compliance affairs of the whole bank, and for issuing opinions conforming to laws and internal regulations. This supervisor leads the personnel of the Legal Compliance Division in jointly managing, planning, and executing the Bank's compliance system. This supervisor also concurrently holds the positions of Chief Legal Officer, Anti-Money Laundering and Counter-Terrorism Financing Officer, and Fraud Prevention Officer. Prior to the Bank launching various new goods, services and applying to the competent authority for handling new businesses, this officer affixes their signature as the responsible person.

The Head Office’s legal compliance units and each domestic unit assigned personnel conforming to legal qualifications to act as their legal compliance supervisor and to be responsible for executing legal compliance matters. They also set assistant legal compliance supervisors in various units (including the Head Office’s branches and various business centers stationed in the branches) to assist the legal compliance supervisors in handing legal compliance matters so as to convey and advocate laws effectively.

Overview and Operation Condition of Legal Compliance

-

Legal Compliance Policies

The legal compliance policies verified by the Board of Directors were the bank-wide supreme guidelines of the Bank’s legal compliance system, and the Board of Directors would make review annually to monitor effectiveness of legal compliance functions. They also grasp implementation condition of the Bank’s legal compliance function via annual legal compliance plan and report on implementation of legal compliance affairs of the whole bank every half year.

Union Bank of Taiwan Compliance Policy -

Promotion of the Legal Compliance System

1.The Bank followed up the latest legal dynamics, and revised its internal regulations appropriately.

The legal compliance units would collect the latest legal regulations on finance every week, and then convey to various units effectively upon summary and arrangement so as to enable the staff to figure out their doubts toward the laws and regulations quickly. They would also assist with various departments in confirming that all operation and management regulations are updated appropriately in cooperation with relevant laws, and supervise the implementation, establishment, and enforcement of internal regulations by legal compliance officers of each unit, thus making the Bank’s operation activities conform to legal regulations and strengthening the legal understanding of Bank personnel.

In addition to including external regulatory documents applicable to various business operations of the Bank, the financial regulations database also contains internal rules and electronic official documents established by the Bank's head office units. The content of the financial regulations database is regularly updated for use by all bank employees, thereby strengthening the Bank's legal compliance function through legal compliance technology.

2.Complete legal compliance training and education

(1)The Bank’s Head Office’s legal compliance supervisor, members of the Head Office’s legal compliance units and various domestic units’ legal compliance supervisors have obtained legal qualifications before taking post. Besides, they should also participate in on-the-job education and training courses on legal compliance held by the competent authority, its designated institution or the Bank itself for at least 15 hours every years to guarantee that they are equipped with the ability to perform the legal compliance mechanism, thus assisting with the senior supervisors in managing the Bank’s legal compliance risks. In 2024, 132 people completed the training for a total of 1,980 training hours.

(2)Regarding new staff, on-the-job staff, senior supervisors and the above-mentioned legal compliance supervisors and staff, the Bank introduced legal compliance courses and communicated and promoted any updates or amendments to regulations at all times, so as to enable all units to grasp the latest standards and comply with regulations. In 2024, 15,515 people completed the training for a total of 1,980 training hours.

(3)To strengthen employees' compliance with service regulations and enhance the correct understanding of legal concepts among employees at all levels, in addition to focusing on promoting risk awareness regarding ethical conduct for senior personnel during manager meetings, the aforementioned physical and online educational courses for newly recruited employees were also incorporated, as well as an online educational course for on-the-job training in legal compliance. A total of 4,291 participants attended these courses, accumulating a total of 15,717 training hours. -

Legal Compliance Risk Monitoring and Appraisal System

A self-assessment of legal compliance is conducted every six months, and the compliance unit performs spot checks on legal compliance every year. The compliance status of each unit is evaluated, and the appraisal results are reported to the Board of Directors and the Audit Committee.

In 2024, the entire bank conducted two self-assessment operations on regulatory compliance. Additionally, one annual regulatory compliance spot check was carried out, which included spot checks of 3 head office units and 90 business units.

The Bank incorporated sustainability-related issues in 2024, including the Code of Practice for Sustainable Development of Listed and Sustainable Development Action Plans for TWSE- and TPEx-listed Companies, into the compliance self-assessment items for verification. The verification results showed no deficiencies. In 2025, the Bank conducted a self-assessment of legal compliance for the first half year on May 12th, also including the "Guidelines for Preventing Greenwashing for Financial Institutions" and the "Guidelines on Carbon Reduction Target Setting and Strategy Planning for the Financial Sector”. The verification results showed no deficiencies.

-

System and Structure

The Bank recognizes the importance of compliance with laws related to anti-money laundering and combating the financing of terrorism. We are committed to preventing our institution from becoming a source of money laundering and terrorist financing. Accordingly, we have established internal regulations including the "Precautions of Union Bank for Money Laundering Control and Combating Terrorist Financing," "Union Bank's Evaluation of Money Laundering and Terrorist Financing Risks and Formulation of Prevention Plan Policy," and the "Union Bank Comprehensive Risk Assessment and Management Measures for Money Laundering and Terrorist Financing." These measures aim to establish a comprehensive anti-money laundering system to prevent the misuse of money laundering and terrorist financing activities.

The Bank allocates adequate personnel and resources dedicated to anti-money laundering and counter-terrorism financing according to its scale and risk profile. Under the Head Office's legal compliance unit, independent specialized units have been established, including the Money Laundering Planning and Management Division, the Money Laundering Transaction Monitoring Division, and the Fraud Prevention Division. The Head Office's Legal Compliance Supervisor serves as the dedicated supervisor, vested with full authority to coordinate and oversee anti-money laundering and counter-terrorism financing efforts. -

Internal Control and Internal Audit Regulations for Compliance with Anti-money Laundering Laws

1.The business units and the Head Office business management units serve as the first line of defense in anti-money laundering efforts, specifically implementing controls related to anti-money laundering and combating the financing of terrorism. Senior management personnel should be appointed as supervisory officers, responsible for overseeing the execution of anti-money laundering and counter-terrorism financing measures within their respective units, as well as managing the self-evaluation process.

2.The primary responsibilities of the dedicated unit are to supervise the prevention of money laundering and the combatting of terrorist financing, to identify and assess the risks of money laundering and terrorist financing, and to monitor the planning and implementation of policies and procedures.

3.The Audit unit conducts inspections of management systems and execution deficiencies in accordance with the "Implementation Rules of Internal Audit and Internal Control System of Financial Holding Companies and Banking Industries." It also regularly reports to the Chief Auditor and the Deputy Director responsible for anti-money laundering and counter-terrorism financing. -

Work Overview

1. Customer Due Diligence

In addition to conducting identity verification, name checks, and risk assessments through the business unit's customer relationship establishment procedures, customer data is also subjected to daily batch scanning via the Anti-Money Laundering (AML) system. Furthermore, relevant regulations have been established to enhance the accuracy of manual verification.

2. Suspicious Transactions Monitoring

Regarding transaction monitoring for existing customers, an Anti-Money Laundering (AML) system has been implemented. This system is utilized to detect abnormal transactions involving customers and accounts. Monitoring effectiveness and intensity have been enhanced through strengthened regulations and the integration of technological applications.

3. Reporting of Large-value and Suspicious Transactions

In response to alert cases generated by the AI early warning system and suspicious abnormal transaction behaviors identified by business units in customers suspected of money laundering, the Bank's suspicious transaction reporting operations have been fully centralized. Dedicated personnel are responsible for conducting customer background investigations, confirming abnormal behaviors, and reporting cases, with the aim of improving the quality of reported cases and reducing omissions in reporting.

4. Fraud Prevention

In response to the increasing emphasis by competent authorities on anti-fraud measures within financial institutions, the Bank established an interdepartmental Fraud Identification Task Force in 2024, chaired by the General Manager. This task force convenes weekly project meetings focused on optimizing fraud identification and prevention workflows. During these meetings, in addition to continuously monitoring the progress of various optimization topics, adjustments are made dynamically to fraud prevention-related issues to enhance the effectiveness of suspicious account monitoring alerts and improve interception accuracy. Furthermore, to support the crackdown on fraud crimes through professional, organized, and sustained efforts, the Bank established the "Fraud Prevention Division" within the Legal and Compliance Department in the first quarter of 2025. This division is responsible for overseeing all fraud crime prevention matters across the bank. Concurrently, the task force was renamed the "Union Bank Financial Fraud Prevention Task Force."

The task force is primarily composed of members from the Bank's Fraud Prevention Division (dedicated unit) and business units related to fraud prevention operations. The task force convenes weekly meetings to oversee and manage the Bank's fraud crime prevention measures, track the progress of projects related to fraud crime prevention, and coordinate the responsibilities of various units concerning fraud crime prevention operations. -

Educational Training

Regarding the training and education of personnel in anti-money laundering and counter-terrorism financing, the Bank continues to enhance employees' professional knowledge in anti-money laundering, fraud prevention, and counter-terrorism financing. The specific implementation results for 2024 are as follows:

1. The Head Office management unit plans for a 100% training completion rate in the annual anti-money laundering education courses for its affiliated business personnel.

2. The dedicated personnel and managers responsible for money laundering prevention, with the consent of the dedicated supervisors, participated in on-the-job education and training provided by external training units for a total of 12 hours. The training attendance rate was 100%.

3. The attendance rate for the "Anti-Money Laundering and Counter-Terrorism Financing On-the-Job Training Course" conducted for directors and senior management was 100%.

4. The dedicated unit conducts a quarterly "Anti-Money Laundering - Know Your Customer" workshop. The course content includes explanations of various customer due diligence procedures, name verification, and methods for identifying and verifying beneficial owners and Politically Exposed Persons (PEPs). In 2024, a total of eight in-person courses were held across the northern, central, and southern regions, with a total of 228 participants attending.

5. The Bank enhanced the professional knowledge of all employees through online courses in regulations related to anti-money laundering and anti-fraud measures, as well as the improvement of identified deficiencies. In 2024, a total of 3,674 employees completed the training.

Development of the enterprise culture of ethical management, all directors and senior management have signed off on the compliance with ethical management policies, and actively implement the commitment to the integrity management policy and supervise the actual implementation of the company's internal management and business activities.

-

Integrity management related

Code of Ethical Conduct for Directors and Managerial -

Fair Treatment of Customers Philosophy

Union Bank of Taiwan has established a corporate culture centered around the philosophy of "Fair Treatment of Customers." To protect customer rights and interests, and in accordance with the Treating Customers Fairly Principles for Financial Institutions issued by the Financial Supervisory Commission, the Bank has formulated the Fair Treatment of Customers Policy and Strategic Implementation Steps. This provides guidance for the three lines of defense in implementing fair treatment principles, and is regularly reviewed and revised to ensure that the Bank treats customers fairly when providing various financial products or services. In addition, to provide more customer-friendly products and quality services that better meet customer needs, the Bank reviews, makes recommendations, and tracks improvements on financial inclusion service policies and their implementation based on customer feedback, while continuously optimizing various financial products and services. Furthermore, the Fair Treatment of Customers system has been incorporated into compliance training courses, with both online and in-person courses being offered. Through educational promotion, these courses enhance employees' awareness and professional knowledge of regulatory compliance and fair treatment of customers. This ensures that employees treat customers fairly and reasonably when conducting business, allowing customers to experience the Bank's care and dedication, thereby increasing customer confidence in the Bank. -

Ten Principles of Fair Treatment of Customers

-

Contracting with Fairness and Integrity:

The responsibilities owed to customers cannot be contractually limited or exempted in advance.

Contracts for providing financial products or services should be established based on principles of fairness, reasonableness, mutual benefit, and good faith.

Any ambiguity in contract terms should be interpreted in favor of the customer. -

Care and Loyalty:

When providing financial products or services, the manager should ensure they are acting in the best interests of the customer.

When entering into agreements with customers for products or services of a fiduciary, entrusted, or similar nature, fiduciary duties should be fulfilled in accordance with applicable regulations or contractual agreements.

Financial or transaction-related information of customers should be kept confidential from third parties, except as otherwise provided by other laws or regulatory authorities. -

Truthful Advertising:

When publishing or broadcasting advertisements and conducting business promotion or sales activities, there shall be no false, fraudulent, concealing or other misleading actions. Specific information should be disclosed according to relevant regulatory requirements to ensure the truthfulness of the advertising content.

The obligations owed to the customer shall not be less than what is stated in advertisements, materials, or explanations provided.

The promotion of financial education should not be used to recommend specific financial products or services. -

Product or Service Suitability:

Before establishing contracts for financial products or services, sufficient understanding of customer information should be obtained to ensure the suitability of such products or services for the customer.

The first sale of high-risk complex products should be approved by the Board of Directors or Executive Board of Directors. -

Notification and Disclosure:

Before establishing contracts for financial products or services with customers, the important contents of such contracts and their associated risks should be fully explained and disclosed to the customer.

For matters involving the collection, processing, and use of customer personal data, customers should be fully informed of their relevant rights regarding personal data protection and the potential disadvantages of refusing consent.

Explanations and disclosures to customers should be made in writing or other formats that customers can fully understand, and the content should include, but not be limited to, important matters concerning customer rights such as transaction costs, potential returns, and risks.

When selling high-risk complex products, records of notification of important contract content and risk disclosure should be kept through audio or video recording, except for automated non-counter channel transactions or cases where the customer does not consent. -

Compensation and Performance Balance:

The compensation system for sales staff should balance and consider factors such as customers’ interests, the various risks that financial products or services may pose to both the Bank and its customers, and the fees charged. It should avoid direct links to the sales performance of specific financial products or solely considering the achievement of sales targets of sales staff. -

Complaint Protection:

The Bank provides appropriate complaint channels for customers and establishes a comprehensive customer dispute resolution system. -

Sales Staff Professionalism:

The Bank's sales staff should possess certain qualifications or participate in regular educational training to ensure their professionalism. -

Friendly Service:

Throughout all stages of designing and selling financial products and services, including conceptualization, development, testing, launching, sales, and review, the needs of specific groups such as the elderly and people with disabilities should be considered.

Plan and implement measures for the fair treatment of specific groups such as the elderly and people with disabilities according to business characteristics. Monitor and evaluate the financial products or services provided to ensure they meet customer needs, and review the effectiveness of processes and regulations for fair treatment of the elderly and disabled customers. Encourage each unit to establish policies, strategies, and internal regulations that exceed current legal requirements to promote sustainable innovation and inclusive financial services. -

Implementation of Ethical Management

Ethical management culture should be promoted from the top down, with related measures planned and implemented, such as an employee code of conduct, conflict of interest prevention measures, appropriate whistleblowing channels, relevant education and training, comprehensive risk management measures, assessment mechanisms for dishonest behavior risks, clearly defined operational procedures in dishonesty prevention programs, disciplinary and grievance systems for violations, implementation and regular review and revision of the aforementioned programs.

An effective accounting system and internal control system should be established, and the Audit Department should formulate relevant audit plans based on the risk assessment results of unethical behavior. These plans should be used to audit compliance with dishonesty prevention programs, or a certified public accountant may be entrusted to perform the audit.

-

Contracting with Fairness and Integrity:

-

Fair Treatment of Customers Management Committee Organizational Structure

Under the Board of Directors, Union Bank of Taiwan has established the Fair Treatment of Consumers Management Committee as the main organization for planning, reviewing, and implementing fair customer treatment issues. The President serves as the convener, and independent directors are invited to attend and provide guidance. Meetings are held regularly, and reports are submitted to the Board of Directors.

-

Union Bank of Taiwan Sustainable Financial Policy

UBOT Sustainable Financial Policy -

Sustainable development bonds and fund investments

The details of our investment in New Taiwan Dollar bonds approved by the Taiwan Securities OTC Trading Center for Green Bonds are as follows:

Bond Name:TSMC 6th Unsecured Corporate Bond in 2020-Tranche B(Short Name:P09台積6B,Bond Code:B618C4) NT$300million.

Bond Name:TSMC 3rd Unsecured Corporate Bond in 2025-Tranche B(Short Name:P14台積3A,Bond Code:B618E2) NT$200million.

Bond Name:TAIWAN POWER COMPANY 4TH UNSECURED BOND-B ISSUE IN 2020(Short Name:P09台電4B,Bond Code:B903XL) NT$200million.

Yuanta Bank 1st Unsecured Financial Debentures in 2024(Short Name:P13元大銀1,Bond Code:G10832) NT$300million.

The total investment balance of ESG funds is US$2.85 million. -

Issuance of Sustainable Bonds

Union Bank of Taiwan issued the first Sustainability bond (Short Name:P14聯邦1,Bond Code:G10924) in August 2025 with a total amount of NT$1 billion.

We have been continuously developing innovative digital financial services, optimizing the digital financial service platform, and actively promoting electronic transactions and services, we also encourage our customers to apply for electronic bills. Through these paperless actions, we hope to achieve the goals of environmental protection, energy conservation and carbon reduction.

Inclusive Finance Statement

In response to the United Nations Sustainable Development Goals (SDGs) and the Inclusive Finance Initiative. The Board of Directors of the Bank issued a statement on inclusive finance and followed this statement to promote financial products and services with the aim of satisfying groups lacking financial services and realizing the vision of inclusive finance, so as to reduce the gap between rich and poor, promote social equity and achieve inclusive growth.

UBOT Inclusive Finance Statement

Inclusive Finance Statement

In response to the United Nations Sustainable Development Goals (SDGs) and the Inclusive Finance Initiative. The Board of Directors of the Bank issued a statement on inclusive finance and followed this statement to promote financial products and services with the aim of satisfying groups lacking financial services and realizing the vision of inclusive finance, so as to reduce the gap between rich and poor, promote social equity and achieve inclusive growth.

UBOT Inclusive Finance Statement

In order to treat employees fairly and protect their rights and interests, the Bank has established the “Employee Performance Appraisal Program” whereby the supervisors of each level will approve the performance appraisals of employees at the end of each year based on various financial and non-financial indicators, and the appraisal results will be used as the basis for promotion, salary adjustment, and performance bonus allocation through self-assessment by employees and performance interviews with supervisors. For business personnel, performance bonuses are paid in accordance with the methods established by each business grade, such as the “Regulations for the Evaluation of Wealth Management Department Personnel” and the “Regulations for the Appointment, Removal, Promotion, and Promotion Evaluation of the Consumer Financial Services Customer Service Specialist” for monthly/quarterly evaluations of performance and non-financial indicators. For the rest of the staff, if there is a profit in the annual financial statements each year, the Board of Directors will consider the operating performance of each grade in the year and approve the unit performance bonus according to the bonus rules set by each grade, such as the “Business Unit Performance Assessment Rules” and the “Key Points of Head Office Management Unit Assessment”, and then the supervisors will adjust the allocation according to the individual performance. In addition, the “Regulations for Handling Employee Reward and Punishment Cases” has been formulated to convene meetings at any time to review reward and punishment cases, and to increase the deduction of bonuses and restrict the appraisal grade according to the reward and punishment situations, in order to establish a fair appraisal, reward, and punishment system and to safeguard the rights and interests of the employees and the overall discipline.

In order to increase employee centripetal force and encourage employee retention, long-term incentive measures are implemented:

˙In accordance with the Bank's Articles of Incorporation, if there is a profit in the annual financial statements, the Company makes appropriations for employee stock dividends and distributes them to employees who have been in the Company for at least two years, and the ratio distributed to grassroots employees shall not be less than 50% of the total distribution amount.

˙A commemorative watch and a crystal trophy will be presented to employees who have reached their 20th and 30th anniversaries of service, and each employee will be recognized at the Head Office's tailgate event.

Employees who have been working for more than one year can apply for transfer by filling out the “Employee Volunteer Service Area Survey Form” in order to immediately understand the inner thoughts and actual needs of employees, so that the balance between rotation and life can be achieved and the functional development of employees can be improved. An employee current job satisfaction survey is conducted on the internal website at the end of each year. In the past five years, the satisfaction rates were 97%, 97.2%, 98%, 97.8%, and 98% respectively.

In 2024, our organization held a total of 35 health promotion seminars. Among them, 12 sessions focused on the three high issues, with a total of 403 participants, indicating that employees are highly concerned about personal health issues and have effectively improved their understanding of health risk factors and their ability to respond to them.

In order to increase employee centripetal force and encourage employee retention, long-term incentive measures are implemented:

˙In accordance with the Bank's Articles of Incorporation, if there is a profit in the annual financial statements, the Company makes appropriations for employee stock dividends and distributes them to employees who have been in the Company for at least two years, and the ratio distributed to grassroots employees shall not be less than 50% of the total distribution amount.

˙A commemorative watch and a crystal trophy will be presented to employees who have reached their 20th and 30th anniversaries of service, and each employee will be recognized at the Head Office's tailgate event.

Employees who have been working for more than one year can apply for transfer by filling out the “Employee Volunteer Service Area Survey Form” in order to immediately understand the inner thoughts and actual needs of employees, so that the balance between rotation and life can be achieved and the functional development of employees can be improved. An employee current job satisfaction survey is conducted on the internal website at the end of each year. In the past five years, the satisfaction rates were 97%, 97.2%, 98%, 97.8%, and 98% respectively.

In 2024, our organization held a total of 35 health promotion seminars. Among them, 12 sessions focused on the three high issues, with a total of 403 participants, indicating that employees are highly concerned about personal health issues and have effectively improved their understanding of health risk factors and their ability to respond to them.

-

Personnel structure

As of the end of 2024, there were 4,367 full-time employees at Union Bank, Union Finance & Leasing International Corporation, Union Information Technology Corp., Union Securities Investment Trust Co., Ltd., Union Finance Co., Ltd., and Union Venture Capital Co., Ltd.Category/Year 2024 Number of employees in Taiwan 4,363 Ratio of total employees (%) 99.91 Ratio of supervisors to total management positions (%) 99.06 Number of overseas employees 4 Ratio of total employees (%) 0.09 Ratio of supervisors to total management positions (%) 0.40 -

Distribution of female employees

category percentage target (by 2030) Women as a percentage of the total labor force 63% >50% Percentage of women in all management positions, including entry-level, mid-level and senior management positions 53% >45% Women as a percentage of all entry-level management positions 58% >45% Percentage of women in top management positions 43% >45% Percentage of women holding management positions in revenue-generating departments as a percentage of all department management positions 42% >50% Percentage of women in STEM (Science, Technology, Engineering, Mathematics) related positions 30% >50% -

Employee turnover rate

Employee turnover rate over the yearsCategory/Year 2021 2022 2023 2024 Number of people at the end of the year 3,932 3,914 3,981 3,997 Employee turnover rate (%) 13.35 14.05 13.36 11.41 Employee voluntary turnover rate (%) 12.87 13.72 13.01 10.96 -

Recruitment

*Percentage of all open vacancies filled with internal hiresCategory/Year 2021 2022 2023 2024 Total number of newly hired employees 445 532 599 472 Internal vacancy filling rate (%)* 38.1 50.9 54.7 66.67 Average recruitment cost 763 3,263 3,798 4,090 internal vacancy filling (by 2024) By gender By age male female 30 years old &Below 30 to 50 years old 50 years old and above Number of Employees 136 168 68 172 64 -

Absentee rate

*Absentee rate in male employees = (Number of occupational sick days taken by male employees + sick days taken by male employees + personal leave days taken by male employees) / Total working days for male.Gender / Year 2021 2022 2023 2024 Male 0.58% 1.36% 0.86% 0.79% Female 0.80% 1.89% 1.23% 1.06% Total 0.72% 1.70% 1.10% 0.96%

* Absentee rate in female employees = (Number of occupational sick days taken by female employees + sick days taken by female employees + personal leave days taken by female employees) / Total working days for female. -

Wage Equality

Category Ratio (Female:Male) Managerial Employees Salary 1.02:1 Managerial Employees Compensation 1.13:1 Nonmanagerial Employees Salary 0.95:1 Nonmanagerial Employees Compensation 0.94:1 -

Salary index: the Difference between Female and Male

Note 1: The salary includes the monthly base salary and perk from January to December; the bonus includes all the variable salary, such as annual leave pay, year-end bonus, and performance bonus etc.Category Gender Difference(%) the Salary Average 9.77% the Salary Median 7.89% the Bonus Average 11.60% the Bonus Median 11.32%

Note 2: Gender Difference (Salary)= (Male Salary- Female Salary)/ Male Salary; Gender Difference (Bonus)= (Male Bonus- Female Bonus)/ Male Bonus.

Thousand unitsFY 2020 FY 2021 FY 2022 FY 2023 FY 2024 a) Total Revenue $14,430,362 $16,688,773 $15,985,339 $17,934,627 $19,826,869 b) Total Operating Expenses $10,198,147 $10,672,705 $10,936,188 $12,070,837 $12,552,681 c) Total Employee Related Expenses (Salary + benefit) $3,965,882 $4,301,694 $4,298,695 $4,682,035 $5,220,579 Human Capital rate of Return (a - (b-c)) / c 2.07 2.40 2.17 2.25 2.39 - The Company promotes the policy of workplace diversity to realize the diversity of employment and fairness of salary and promotion opportunities, and all policies do not discriminate on the basis of gender, sexual orientation, race, class, age, marriage, language, ideology, religion, party affiliation, nationality, place of birth, appearance, facial features, physical or mental handicap, or any form of discrimination.In 2024, 63.4% of the employees were female and 53.1% of the supervisors were female; 25.8% of the employees were under 30 years old, 52% were over 30 years old and under 50 years old, and 22.2% were over 50 years old; and in accordance with the provisions of the “Law for the Protection of Rights and Interests of Persons with Physical and Mental Disabilities”,17 employees with disabilities have been hired.

- The Employee Welfare Committee has been established and contributes 0.5% of the employees' salaries and 0.1% of the employees' operating revenues to the Employee Welfare Committee for the purpose of handling employee welfare matters, such as giving annual bonuses, organizing Mother's Day parties, and providing subsidies for marriages, funerals, births (including those of spouses), and major natural disasters.

- In order to promote family care benefits and in line with the Labor Standards Act, physiological leave, maternity leave, paternity leave, paternity leave, and abortion leave have been established; employees may apply for leave without pay for childcare before their children reach the age of 3. The Bank has also set up a breastfeeding room to provide a quality breastfeeding environment for its female colleagues.

- Processes employee preferential deposits, employee preferential guaranteed loans and unsecured consumer loans.

- The Bank provides group insurance (including term life insurance, group injury insurance, work-related injury insurance, occupational disaster insurance, cancer health insurance, and hospitalization and medical insurance for employees and their dependents) in accordance with the social insurance system.

- The Bank has established a retirement plan for its employees and set up a Labor Retirement Reserve Supervisory Committee. 2%~15% of the reserve fund is deposited in the Trust Department of the Bank of Taiwan in order to protect the rights and interests of the laborers, and the Bank will pay a pension to any employee who applies for the retirement system under the Labor Standards Law, and whose seniority meets the requirements for retirement under the Labor Standards Law or the Bank's work rules. The Labor Pension Act came into effect on July 1, 2005, and the Bank contributes 6% of the employees' monthly pension to the employees' individual pension accounts in accordance with the Act.

- The Bank has established a Labor and Employee Meeting Regulations to maintain harmonious labor relations at all times.

- UBOT Occupational Safety and Health Guidelines

- UBOT Occupational Safety and Health Management Regulations

-

Human Rights Policy

UBOT Human Rights Policy

Union Bank of Taiwan Human Rights Policy and implementation results

-

Talent Development

In response to the rapid changes in financial technology, the digital economy, and ESG (Environmental, Social, and Governance) trends, we have implemented a talent development program that provides intensive employee training courses. This initiative aims to streamline operational processes, enhance customer service levels, and cultivate well-rounded financial service professionals, ultimately strengthening employee competitiveness and promoting corporate sustainability. -

Training Overview

Category Internal Training External Training Digital Learning Total Number of Trainees (instances) 15,210 6,869 47,699 69,778 Training Expenses (NTD) 9,600,715 5,376,745 568,800 15,546,260 -

Training System

Employee Development Training SeriesTarget Audience Reserved Managers Middle Managers New Employees Course Advanced Management Talent Program Cross-Generational Communication & Leadership Seminars Pre-Employment Training for New Bankers Duration 168 hours 3 hours 256 hours Participants 23 employees 91 employees 188 employees -

Employee Professional Training Series

- Internal Audits & Controls

- Anti-Money Laundering

- Regulatory Compliance

- Business-related Training

- Information Security

- Digital Finance

- Fair Customer Treatment

- Sexual Harassment Prevention

-

Sustainable Finance

Category Beginner Level Intermediate Level Digital Learning Target Audience Business Unit Operators Experienced Personnel All Employees Participants 1,177 327 3,951

-

Learning Maps by Job Function

-

Deposits & Remittances

-

Introductory Level

Deposits & Remittances Operations (Basic) -

Intermediate Level

AML System and Anti-Money Laundering: Customer Due Diligence Training Course -

Advanced Level

Deposits & Remittances Operations (Intermediate)

-

Wealth Management

-

Introductory Level

Wealth Management Training (Basic) -

Intermediate Level

Wealth Management Training (Intermediate) -

Advanced Level

Wealth Management Training (Advanced)

-

Corporate Finance Officers

-

Introductory Level

Credit Investigation & Loan Approval (Basic) -

Intermediate Level

Credit Investigation & Loan Approval (Intermediate)

-

Corporate Finance AO Assistants

-

Introductory Level

Practical Training for Corporate Finance AO Assistants (Basic) -

Intermediate Level

Practical Training for Corporate Finance AO Assistants (Intermediate) -

Advanced Level

Practical Training for Corporate Finance AO Assistants (Advanced)

-

Introductory Level

-

Employee Training Statistics (Year 2024)

Note: Average Training Hours per Employee = Total Training Hours / Total ParticipantCategory Type Sessions Total Participants Total Training Hours Average Training Hours per Employee Internal Training Professional Courses 236 50,805 192,867 3.80 Pre-Employment Training 7 363 2,834 7.81 ESG 1 173 173 1.00 Occupational Safety 1 3,899 3,899 1.00 Subtotal 245 55,240 199,773 3.62 External Training Professional Courses 465 10,360 60,901 5.88 Corporate Governance 7 62 186 3.00 ESG 27 3,950 11,858 3.00 Occupational Safety 66 131 1,442 11.01 Leadership Training 13 35 3,963 113.22 Subtotal 578 14,538 78,350 5.39 Total 823 69,778 278,123 3.99 -

Average Employee Training Hours

Year 2024 - Average Training Hours Male Female Total Hours Average Hours Position Management Level 72.78 87.78 54,425 80.75 Non-Management Level 67.53 67.24 223,698 67.34 -

Employee Professional Certification Statistics

Total Employees: 3,997Certification Type Quantity Financial Certifications 23,169 Sustainability 456 Non-Financial Certifications 1,253 Language Proficiency Certifications 70 Total 24,948

Average Certifications per Employee: 6 -

Effectiveness of Training Programs

Advanced Management Talent Program-

Diverse Courses:

- Next-Gen Leadership Development

- Communication & Presentation Skills

- Corporate Management & Social Responsibility

- Talent Management

-

Professional Courses:

- Report Analysis

- Financial Business Project Studies

- Anti-Money Laundering Case Studies

-

Sustainability Courses:

- Green Energy Industry Development

- Carbon Credit Trading

- Green Electricity

-

Digital Finance:

- ChatGPT

- AI Evolution

- AI Applications in Banking

- iPASS Data Empowerment

- Big Data Applications

- Industry Visits

- Provided a clearer vision for the bank’s future development

- Enhanced self-value and professional capabilities

- 23 participants completed training in Year 2024, with 22% promoted to managerial roles

-

Diverse Courses:

-

Healthy & Safe Workplace

- Established “Workplace Safety and Health Guidelines” and “Occupational Health and Safety Regulations”

- Continuously improving workplace safety and hygiene conditions to reduce occupational hazards and safeguard employees' physical and mental well-being Key Initiatives:

- Conducted 26 on-site professional medical consultation sessions

- Monthly employee health awareness programs

- Bank-wide "Musculoskeletal Symptoms Survey" (4,352 responses in Year 2024)

- Conducted 46 health promotion lectures

-

Organized training on psychological and physical workplace safety, covering:

- Protection against workplace violence

- Workload management

- Human factor hazards

- Maternal health protection

- Sexual harassment prevention

Total participants: 4,271 (Year 2024)

-

Sustainability Development Training Plan

- Regular training sessions based on sustainability guidelines.

- Incentives of NT$1,300 for employees obtaining sustainability certification.

- 3,834 employees completed sustainability-related e-learning courses.

- 2 special sessions for directors & executives: “Impact Investment & SDGs” and “IFRS Sustainability Disclosure Standards S1 & S2”.

- By end of 2024, 456 employees obtained sustainability certifications.

-

Friendly Financial Service Plan

- In line with financial service accessibility standards (CRPD compliance).

- Mandatory training for directors, executives, and staff.

- 3,951 employees completed Financial Accessibility Training for People with Disabilities, including all directors and senior managers.

-

Digital Learning Plan

- As internet technology advances, some in-person training sessions are shifting to online formats

- Dedicated training portal established for digital courses

- Adoption of video conferencing software for meetings and announcements, reducing commuting time and carbon footprint

- 91 courses uploaded to the training portal, with 47,699 enrollments

- Monthly financial management training and four weekly morning meetings conducted via video conferencing software

-

Industry-Academia Collaboration Plan

To ensure a sustainable talent pipeline, we have partnered with over 30 universities to provide internship opportunities for students, allowing them to gain hands-on industry experience.

Plan to collaborate with universities to implement the employment program promoted by the Ministry of Labor, cultivating students' professional financial knowledge, enhancing their understanding of banking practices, and assisting them in increasing their willingness to enter the financial industry.

Year 2024 Outcomes:- 298 internship applications received, 85 students onboarded (nearly 50% retention rate)

- 18 students participated in the Employment Program

-

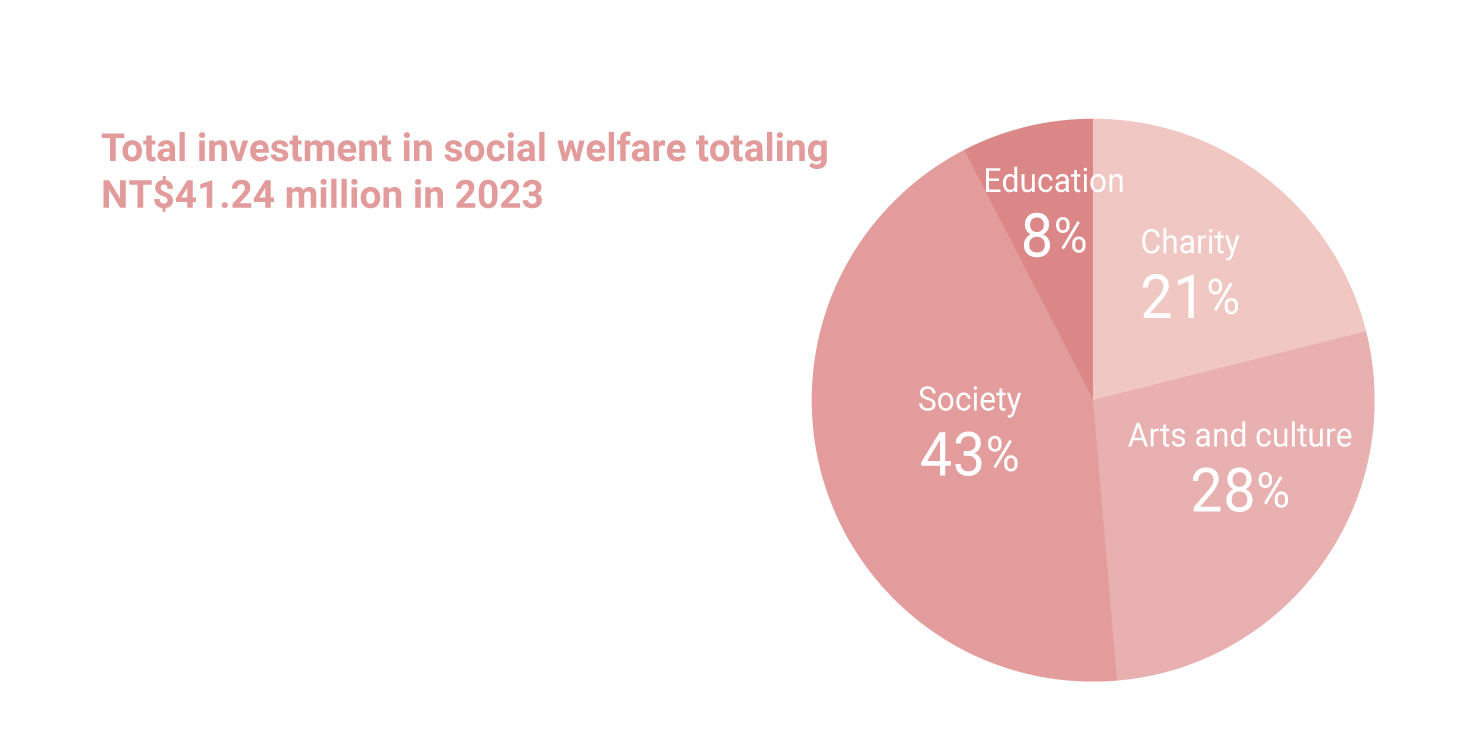

In order to fulfill corporate social responsibilities and enhance social well-being, we have cared about all the people and things in Taiwan for a long time. Including educational promotion, participation in arts and culture, social care to charity ,we execute specific actions in social welfare as follows:

- Total investment in social welfare totaling NT41.24 million in 2023

- Commitment Letter on Compliance with CSR, Ethical Management and Legal Provisions

- UBOT of Supplier Management Policy

- Supplier Self-Assessment Form

-

Corporate Ethics

- Engaging in business activities based on the principles of fairness, honesty, trustworthiness, and transparency, we implement a policy of integrity in operations and actively prevent dishonest behavior. This is in accordance with the principles outlined in the "Ethical Management and Guidelines for TWSE/TPEx Listed Companies" and our own Ethical Corporate Management Best Practice Principles in Business Operations.

- Due to the necessity of obtaining confidential information for business purposes, it is imperative to strictly adhere to the relevant regulations concerning intellectual property rights and the company's operational guidelines. Employees must not disclose any company trade secrets, trademarks, patents, copyrights, or other intellectual property of which they are aware to any third parties. Furthermore, employees are prohibited from inquiring about or collecting any company trade secrets, trademarks, patents, copyrights, or other intellectual property that are not pertinent to their job responsibilities.

- Business activities should be conducted in accordance with the Fair Trade Act and relevant competition regulations.

- Marketing and labeling of products and services must comply with relevant regulations and international standards. Deceptive, misleading, fraudulent, or any other actions that undermine consumer trust and violate consumer rights are strictly prohibited.

-

Employee Rights and Welfare

- It is essential to comply with the Labor Standards Act and relevant labor regulations, while also respecting internationally recognized principles of fundamental labor rights. This includes adherence to international human rights conventions, such as gender equality, the right to work, and the prohibition of discrimination, in order to uphold and protect the dignity and basic human rights of employees.

- Provide employees with a safe and healthy working environment, ensure compliance with local labor safety and health regulations, mitigate hazardous factors in the workplace, and prevent occupational accidents.

-

Environmental Protection

- It is essential to comply with environmental regulations and to appropriately protect the natural environment. During the implementation of operational activities and internal management, efforts should be made to enhance the efficiency of resource utilization, considering the impact of operations on ecological benefits. Under the premise of meeting product quality requirements, priority should be given to using recycled materials that have a low environmental impact, ensuring the sustainable use of Earth's resources to achieve the goal of environmental sustainability.

- To mitigate the impact of operations on the natural environment and society, and to promote the concept of sustainable consumption, the Bank and its suppliers should adopt the principle of environmental protection. This entails minimizing emissions of pollutants, toxic substances, and waste, as well as ensuring proper waste disposal management. Furthermore, we must prevent the contamination of water, air, and land during research and development, procurement, production, operations, and service activities, thereby taking responsibility for environmental protection and management.

- It is advisable to consult applicable domestic and international standards or guidelines for conducting greenhouse gas inventories. Attention should be given to the impact of climate change on operational activities, and relevant carbon management measures should be formulated to mitigate the effects of these activities on climate change.

| Chapter1. UBOT Energy and Environmental Management Policy |

|---|

|

| Chapter3. Water Consumption, Total Waste Generation, and Reduction Targets, Initiatives, and Achievement Status |

|---|

|

I. Water Consumption and Total Waste Generation in the Past Two Years: 2023

UBOT has designated 2023 as the base year and set a target of reducing water consumption by 8% by 2035. III. Reduction Measures:

In 2024, UBOT replaced 20 water-saving toilets and 15 faucets certified with water-efficiency labels, resulting in an estimated reduction of approximately 0.08% in water consumption. |

| Chapter4. Energy and Environmental Management Systems and Certifications (ISO 50001, ISO 14001) |

|---|

|